The coronavirus outbreak, which originated in China, has infected more than 550,000 people. Its spread has left businesses around the world counting costs.

Here is a selection of maps and charts to help you understand the economic impact of the virus so far.

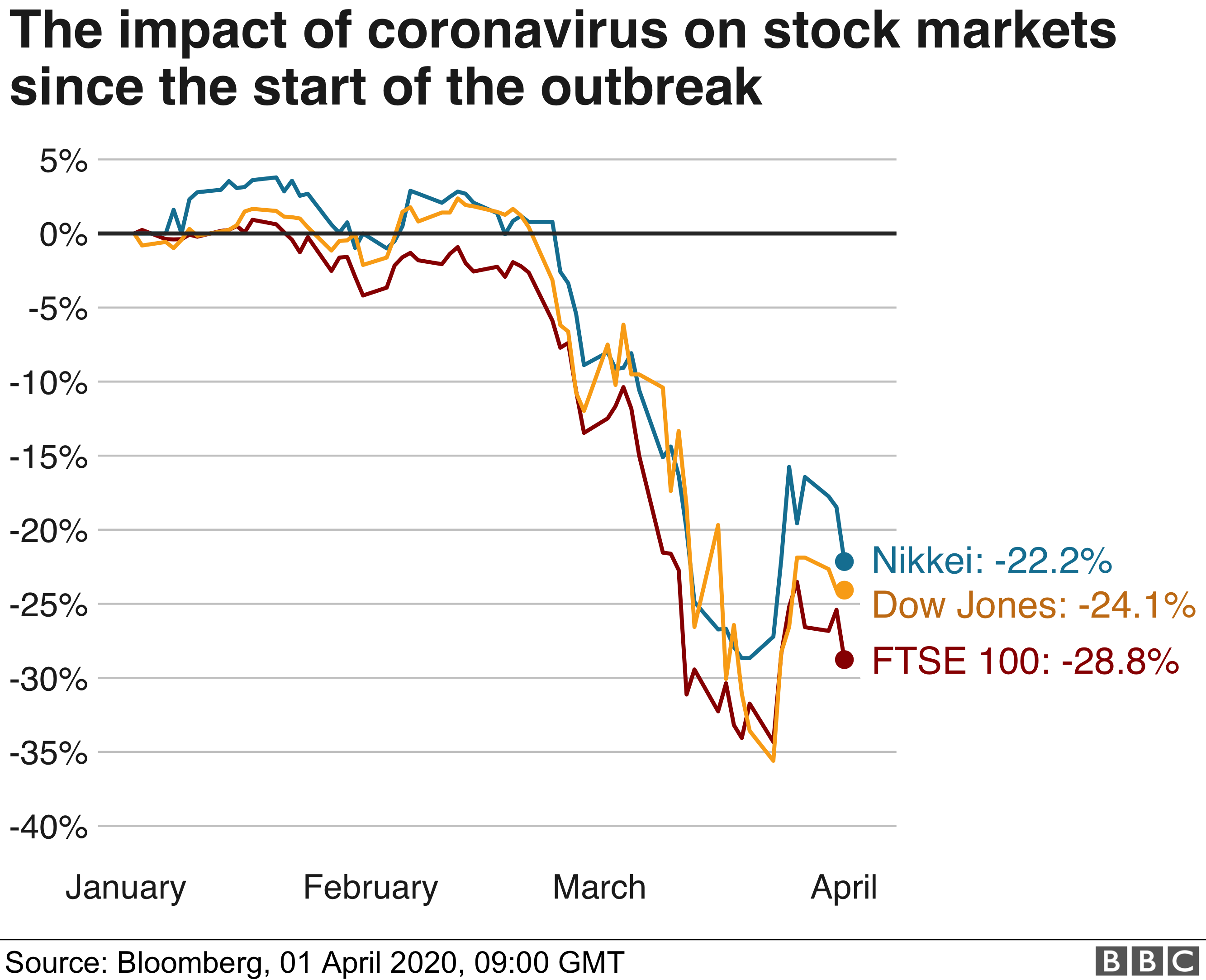

Global shares take a hit

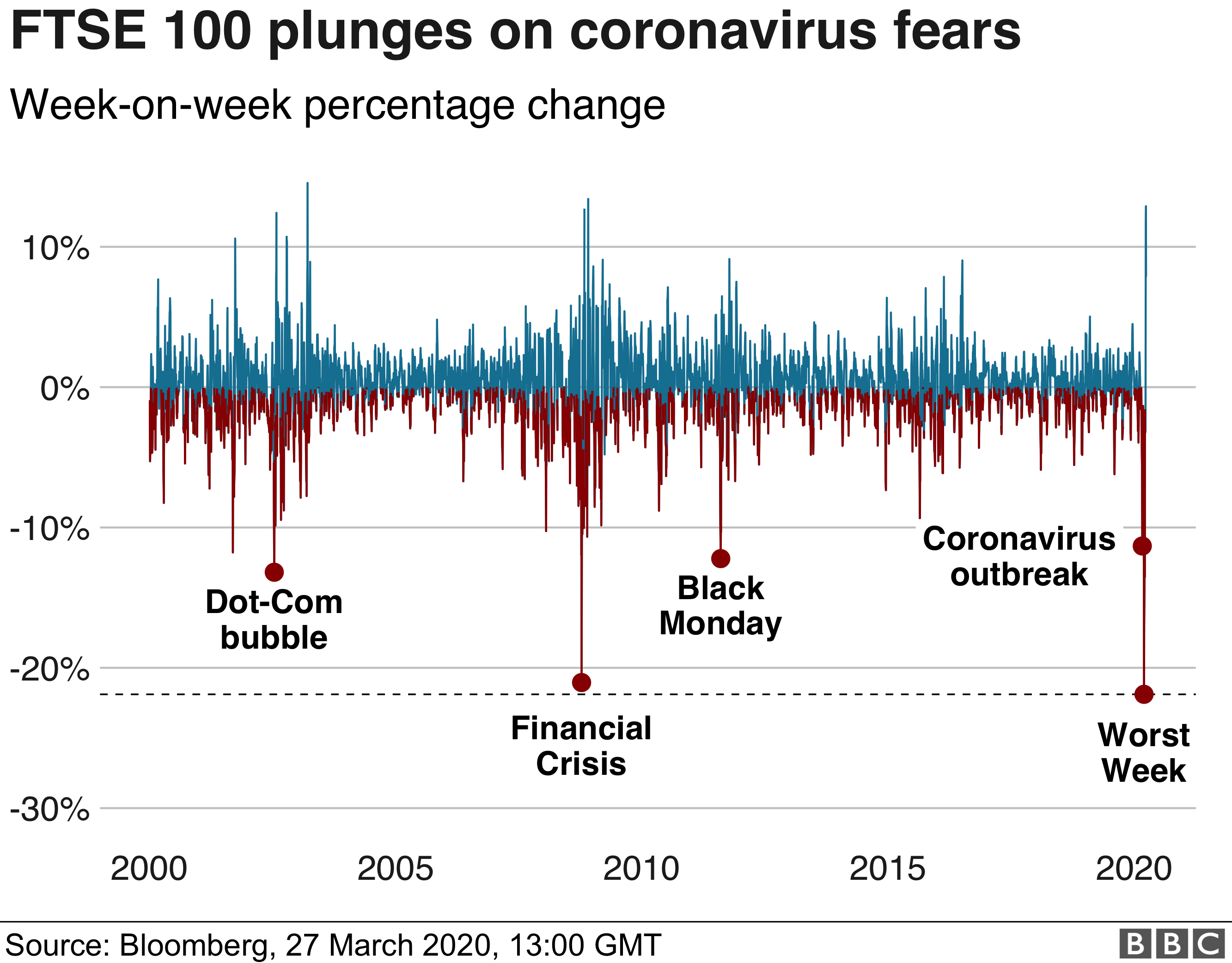

Big shifts in stock markets, where shares in companies are bought and sold, can affect many investments in pensions or individual savings accounts (ISAs).

The FTSE, Dow Jones Industrial Average and the Nikkei have all seen huge falls since the outbreak began on 31 December.

The Dow and the FTSE recently saw their biggest one day declines since 1987.

Investors fear the spread of the coronavirus will destroy economic growth and that government action may not be enough to stop the decline.

In response, central banks in many countries, including the United Kingdom, have slashed interest rates.

That should, in theory, make borrowing cheaper and encourage spending to boost the economy.

Global markets did also recover some ground after the US Senate passed a $2 trillion (£1.7tn) coronavirus aid bill to help workers and businesses.

But some analysts have warned that they could be volatile until the pandemic is contained.

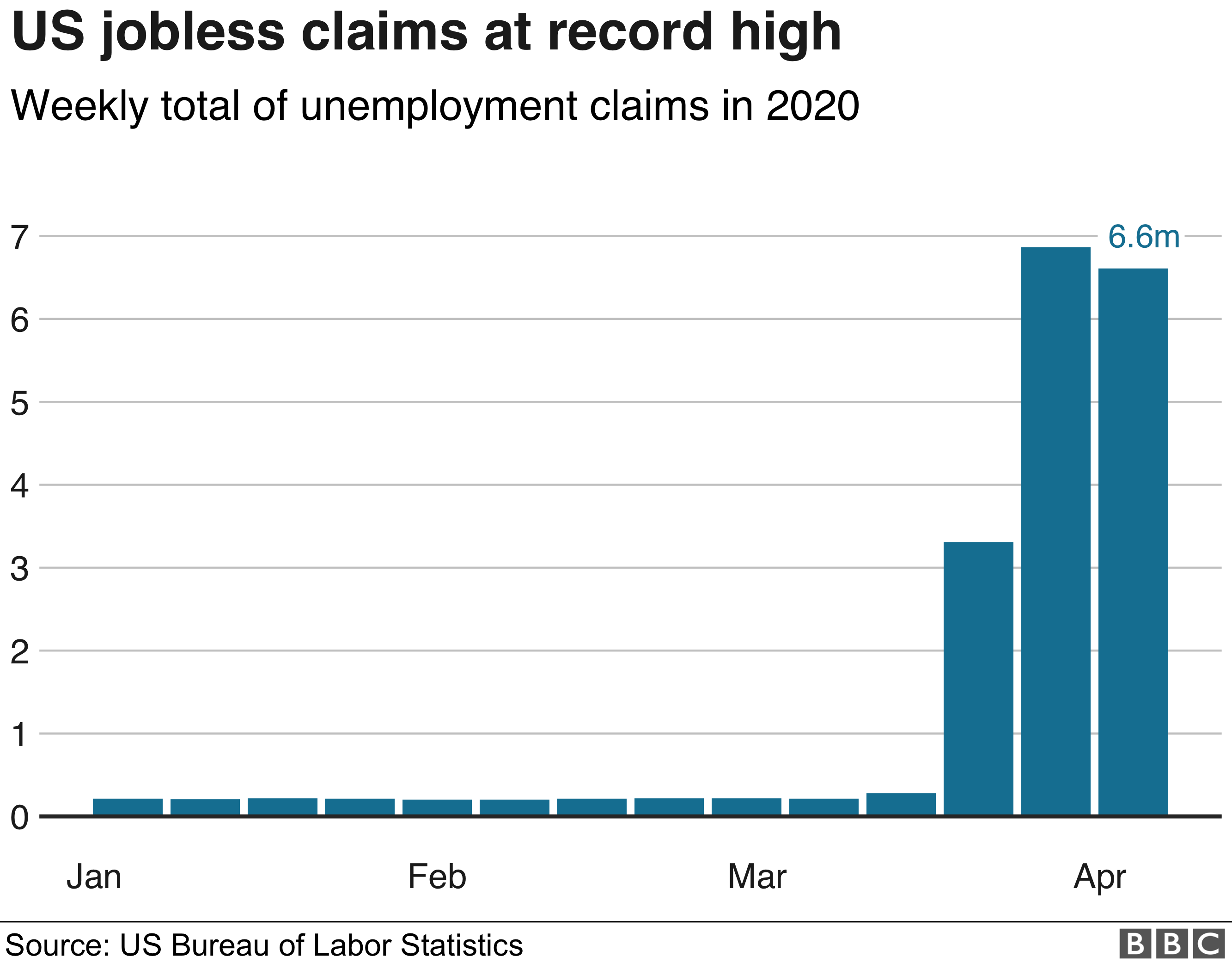

In the United States, the number of people filing for unemployment hit a record high, signalling an end to a decade of expansion for one of the world’s largest economies.

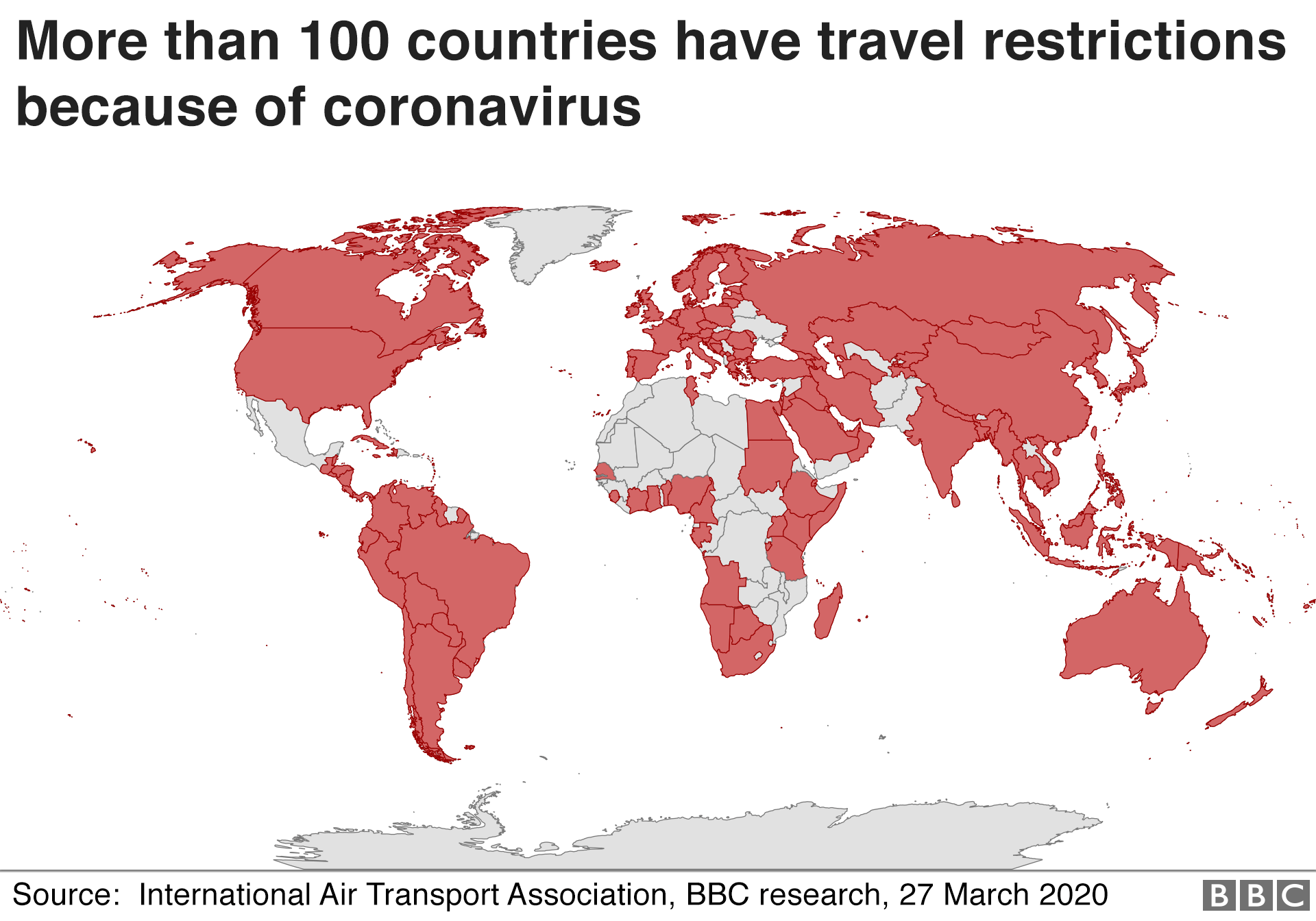

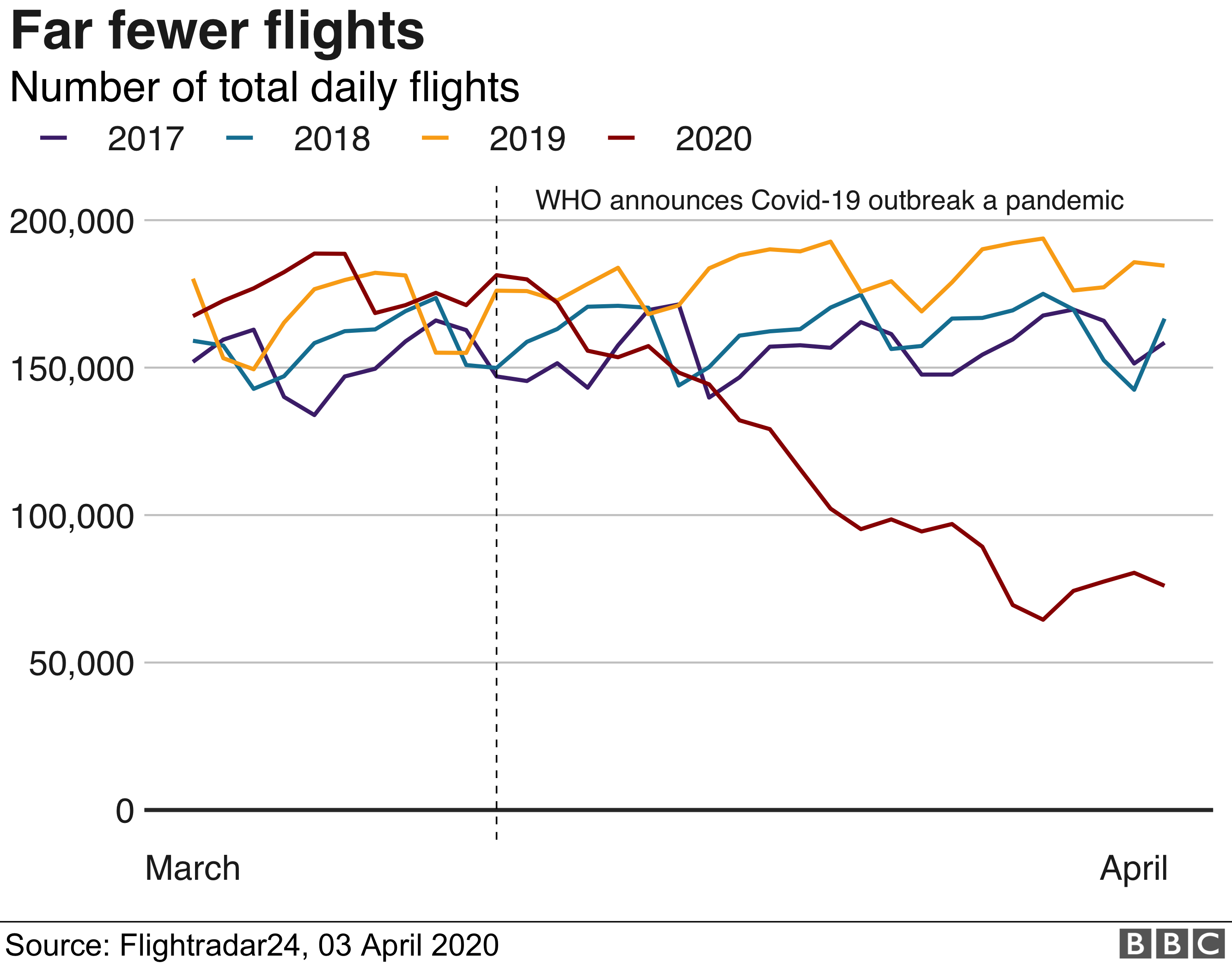

Travel among hardest hit

The travel industry has been badly damaged, with airlines cutting flights and tourists cancelling business trips and holidays.

Governments around the world have introduced travel restrictions to try to contain the virus.

The EU banned travellers from outside the bloc for 30 days in an unprecedented move to seal its borders because of the coronavirus crisis.

In the US, the Trump administration has banned travellers from European airports from entering the US.

Data from the flight tracking service Flight Radar 24 shows that the number of flights globally has taken a huge hit.

UK travel industry experts have also expressed concerns about Chinese tourists being kept at home. There were 415,000 visits from China to the UK in the 12 months to September 2019, according to VisitBritain. Chinese travellers also spend three times more on an average visit to the UK at £1,680 each.

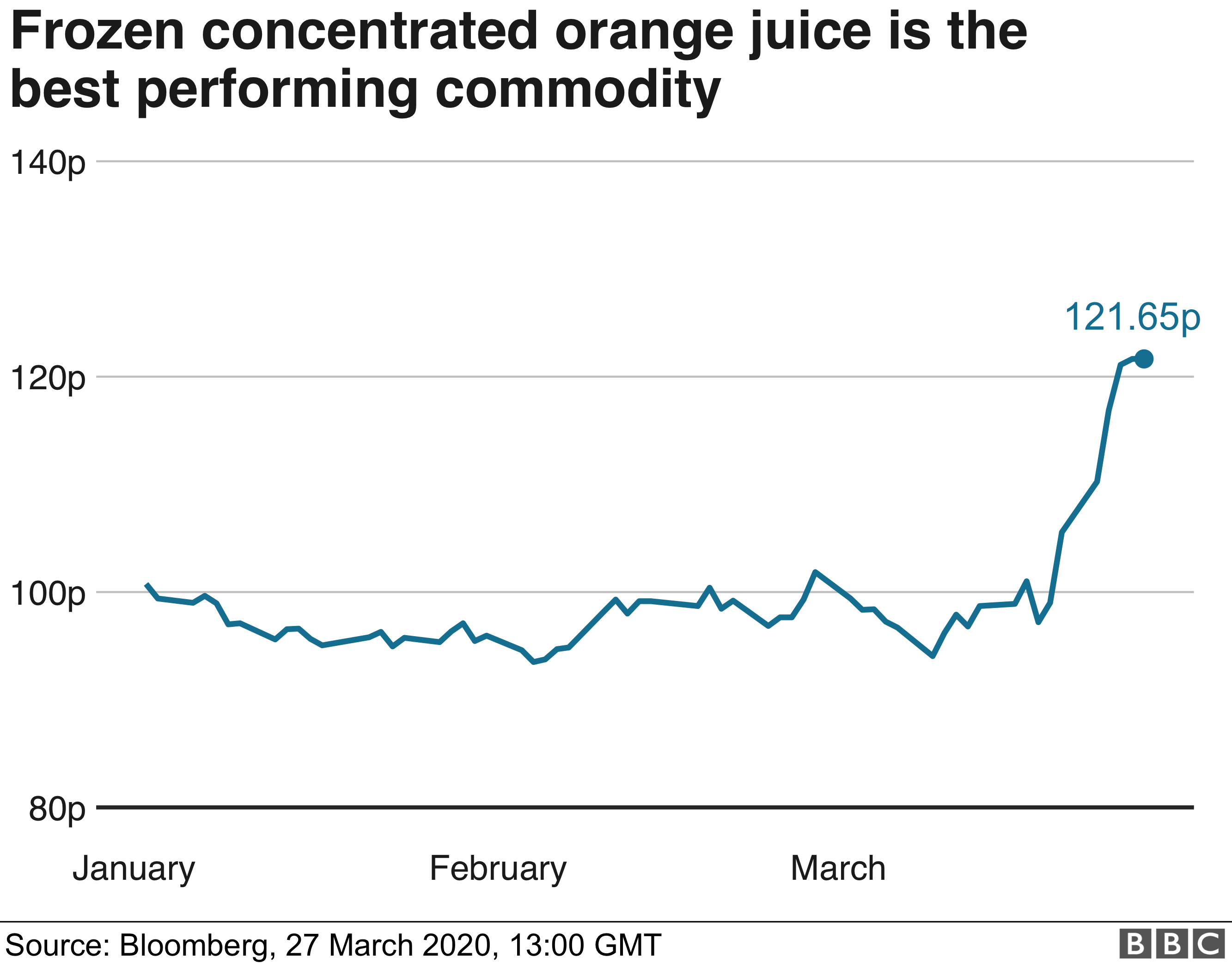

Consumers stockpiling food

Supermarkets and online delivery services have reported a huge growth in demand as customers stockpile goods such as toilet paper, rice and orange juice as the pandemic escalates.

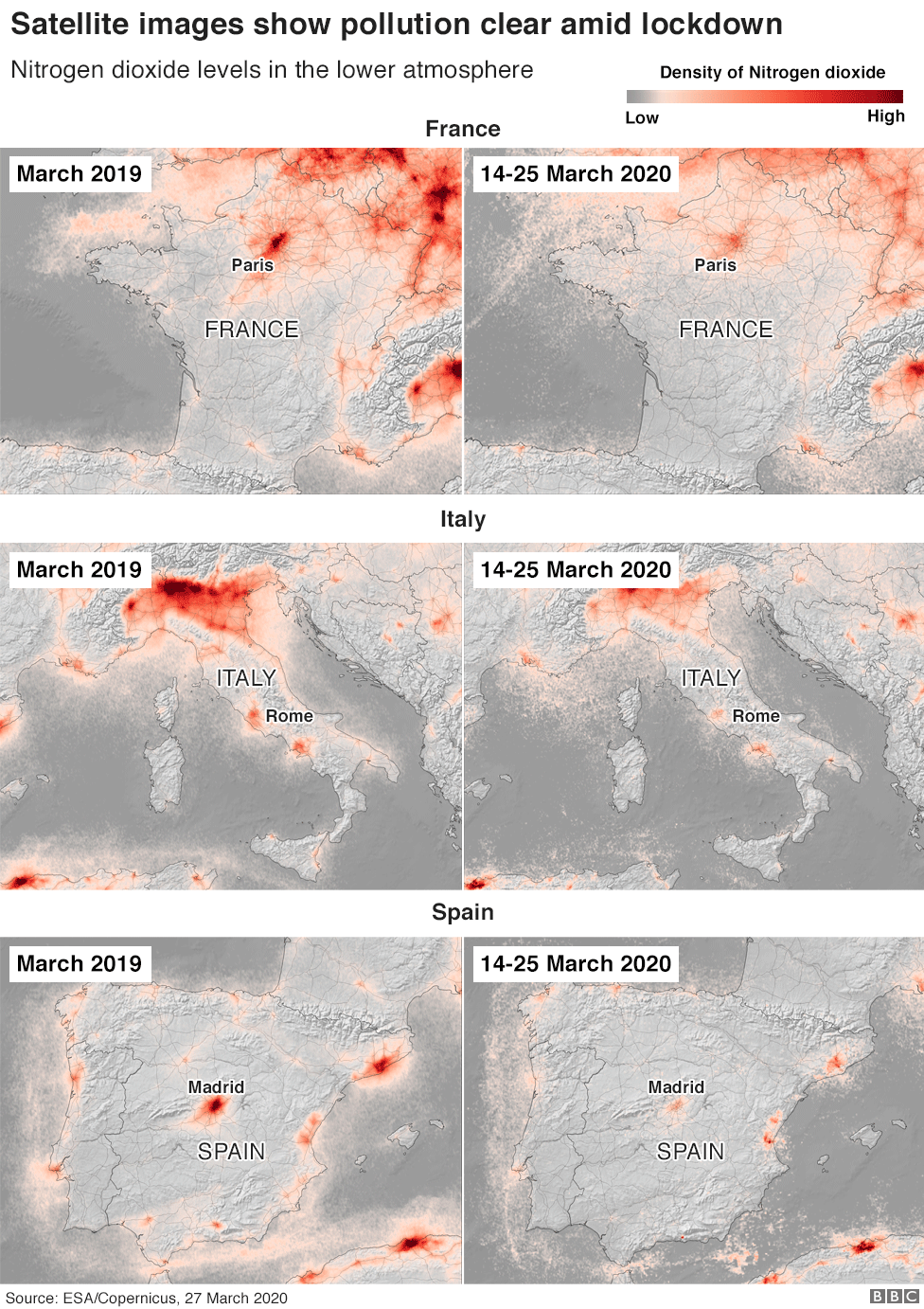

The effects of lockdowns are visible

In order to stop the spread of the Covid-19 outbreak, many countries across the world have started implementing very tough measures. Countries and world capital have been put under strict lockdown, bringing a total halt to major industrial production chains.

The European Space Agency has registered an impressive fall in pollution across the European skies.

The new images clearly show how a strong reduction in emission is now in place over major cities across Europe – in particular Paris, Milan and Madrid.

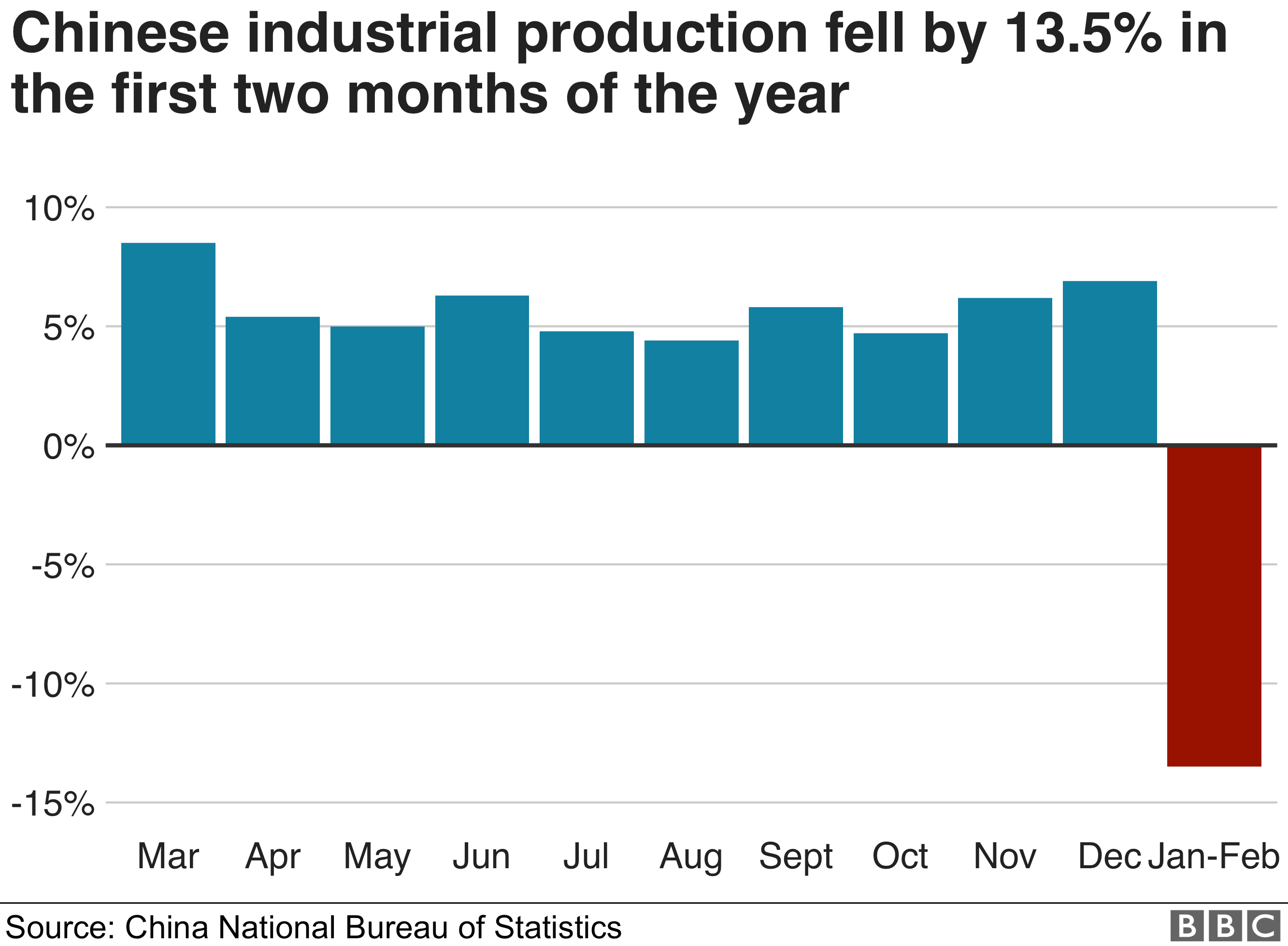

Factories in China slowed down

In China, where the coronavirus first appeared, industrial production, sales and investment all fell in the first two months of the year, compared with the same period in 2019.

China makes up a third of manufacturing globally, and is the world’s largest exporter of goods.

Restrictions have affected the supply chains of big companies such as industrial equipment manufacturer JCB and carmaker Nissan.

Shops and car dealerships have all reported a fall in demand.

Chinese car sales, for example, dropped by 86% in February. More carmakers, like Tesla or Geely, are now selling cars online as customers stay away from showrooms.

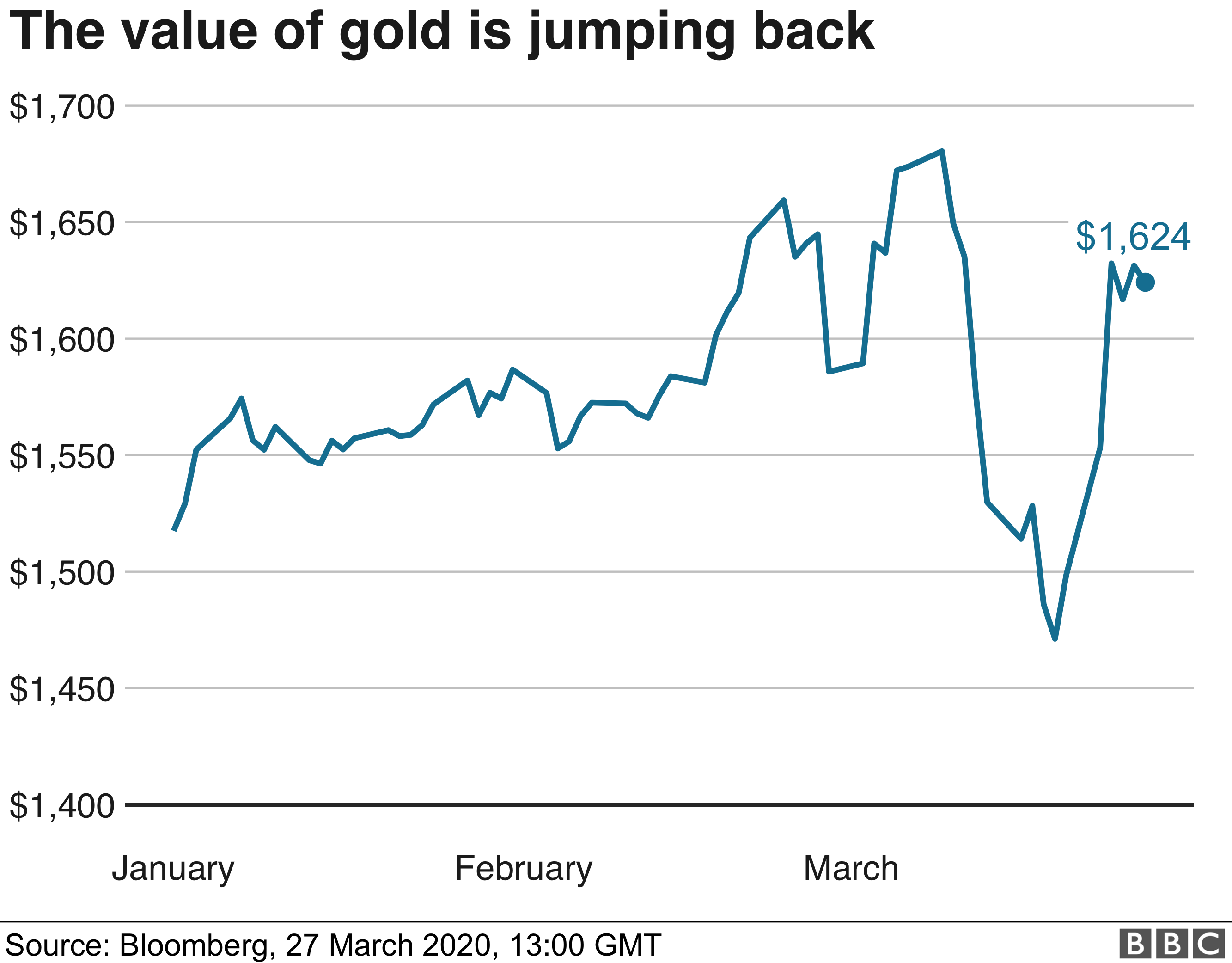

Even ‘safer’ investments hit

When a crisis hits, investors often choose less risky investments.

Gold is traditionally considered a “safe haven” for investment in times of uncertainty.

But even the price of gold tumbled briefly in March, as investors were fearful about a global recession.

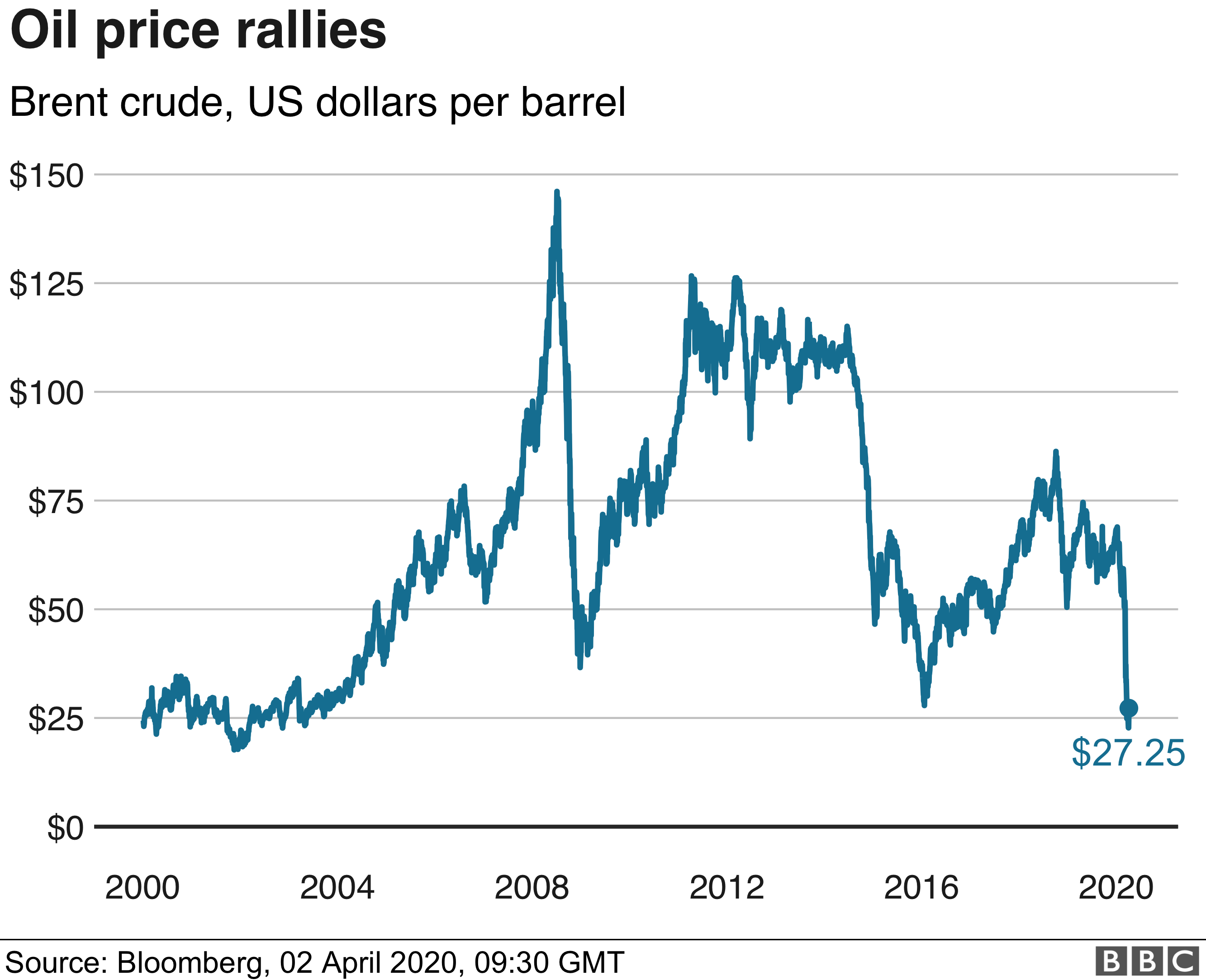

Likewise, oil has slumped to to prices not seen since June 2001.

Investors fear that the global spread of the virus will further hit the global economy and demand for oil.

The oil price had already been affected by a row between Opec, the group of oil producers, and Russia. Coronavirus has driven the price down further.

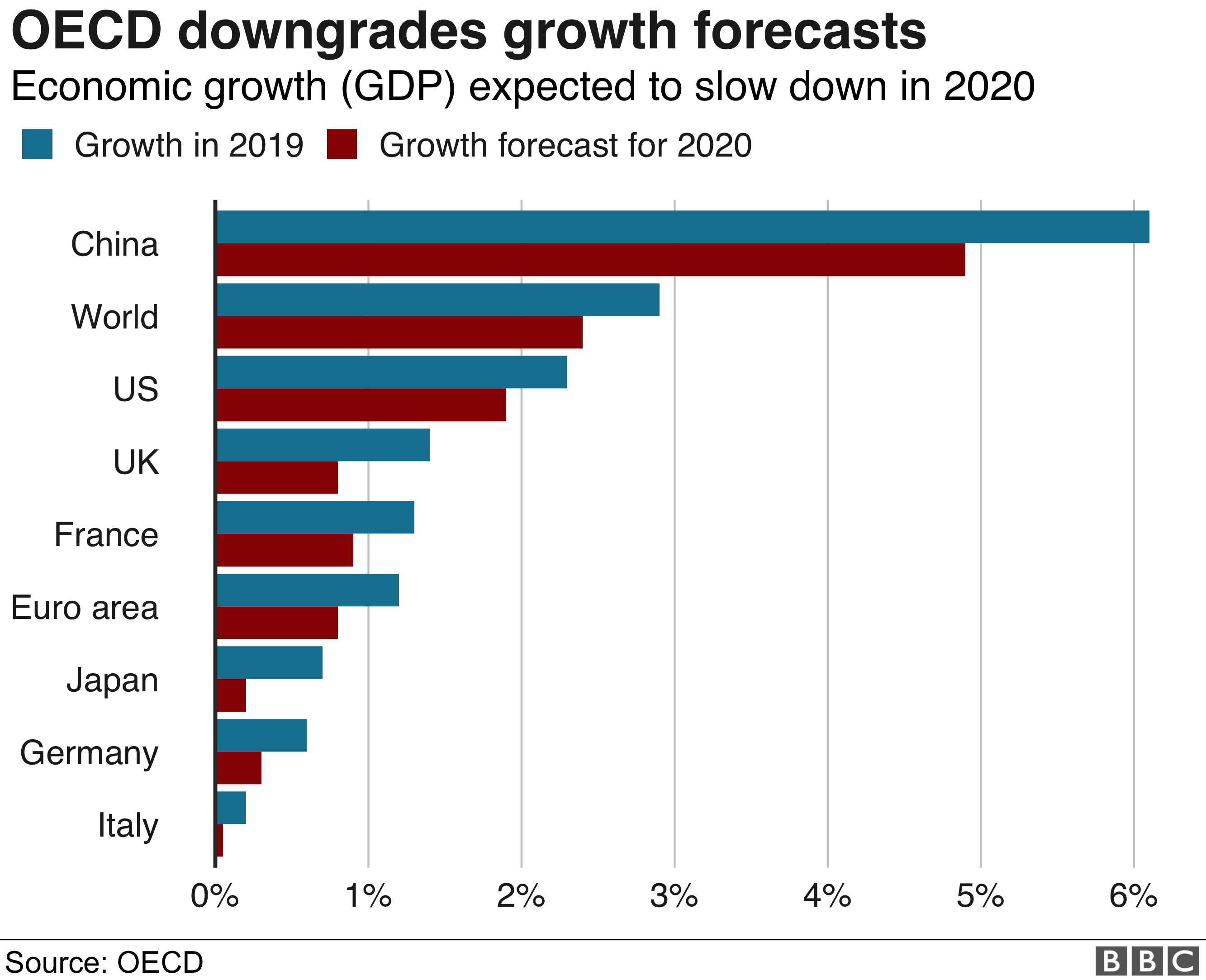

Growth set to stagnate

If the economy is growing, that generally means more wealth and more new jobs.

It’s measured by looking at the percentage change in gross domestic product, or the value of goods and services produced, typically over three months or a year.

The world’s economy could grow at its slowest rate since 2009 this year due to the coronavirus outbreak, according to the Organisation for Economic Cooperation and Development (OECD).

The think tank has forecast growth of just 2.4% in 2020, down from 2.9% in November.

It also said that a “longer lasting and more intensive” outbreak could halve growth to 1.5% in 2020 as factories suspend their activity and workers stay at home to try to contain the virus.